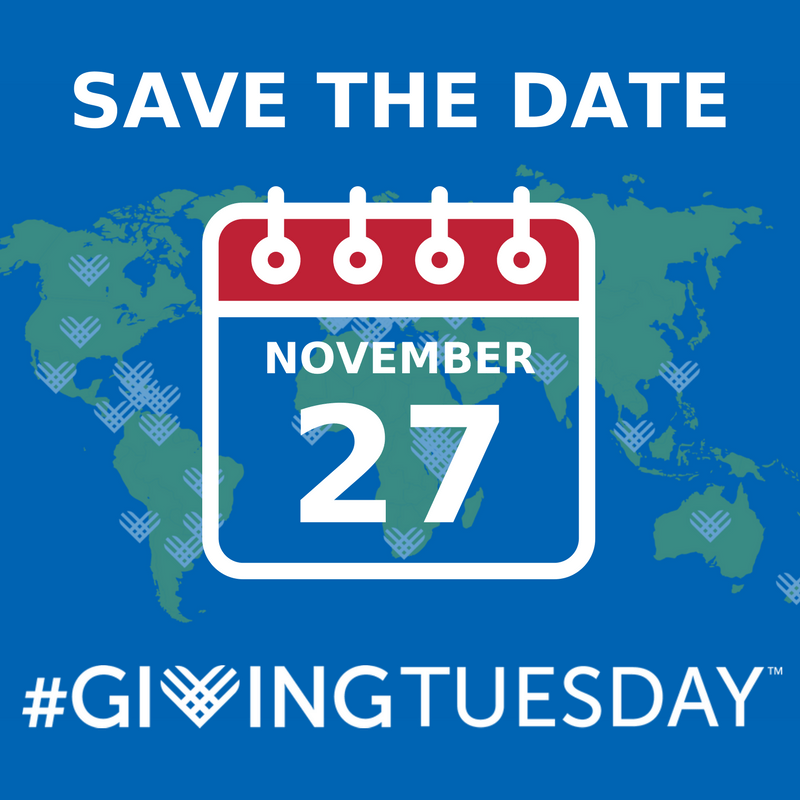

#GivingTuesday Donations to be Matched

AWS Foundation is generously offering to support disability services in northeast Indiana on #GivingTuesday 2018. New gifts, and increased gifts, to Carey Services will be matched dollar for dollar only on #GivingTuesday. Stay tuned for more information on how to give to Carey Services on November 27 and see your donation have even greater impact for the individuals we serve.